Zesty Insights

Dive into the world of news and information with engaging articles.

Valuations in Freefall: A Surprising Silver Lining for Investors

Discover why falling valuations might be the best news for savvy investors. Uncover hidden opportunities in the market today!

Understanding the Impact of Falling Valuations on Investment Opportunities

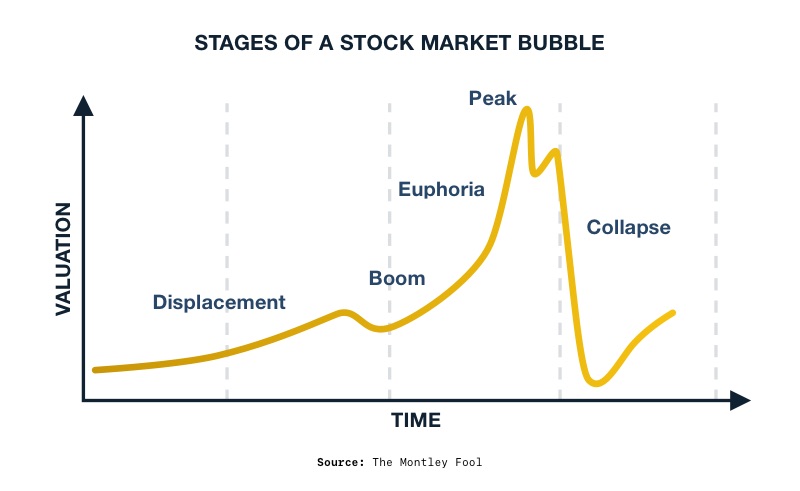

As the market experiences fluctuations, falling valuations can have a profound impact on investment opportunities. When asset prices decline, it may signal a buying opportunity for savvy investors looking to capitalize on undervalued assets. Historically, periods of falling valuations have often led to attractive entry points for long-term investors, particularly when companies maintain strong fundamentals. However, it is crucial to conduct thorough analysis to distinguish between genuine opportunities and potential pitfalls hidden behind a declining price.

Moreover, the effects of falling valuations extend beyond individual investment decisions; they can also influence broader market sentiment and investor behavior. When valuations drop, fear and uncertainty can lead to increased volatility, causing even fundamentally sound companies to suffer. This creates a paradox where investment opportunities become available, yet fear of further declines can paralyze potential investors. Understanding these dynamics is essential for navigating the complex landscape of investment opportunities during periods of market distress.

Counter-Strike is a highly popular tactical first-person shooter that has captivated gamers worldwide since its inception. With its competitive gameplay and strategic depth, players engage in intense missions that require teamwork and skill. Recently, the skin market recovery has garnered attention as players look to understand the fluctuating values of in-game items.

How to Identify Hidden Gems Amidst Market Declines

Identifying hidden gems amidst market declines requires a keen eye for opportunity and a willingness to dig deeper than surface-level analysis. One effective approach is to analyze financial ratios such as price-to-earnings (P/E) ratios and price-to-book (P/B) ratios. When these numbers are lower than the industry average, it might indicate that a stock is undervalued and has potential for growth. Additionally, keeping an eye on earnings reports and management guidance can provide insights into how companies are poised to weather economic downturns.

Furthermore, exploring sector trends can reveal industries that are resilient or even thriving during downturns, such as essential consumer goods or technology with innovative solutions. Conducting thorough research on companies within these sectors can lead to discovering high-quality stocks that others may overlook. Consider utilizing a variety of tools, such as stock screeners and financial news platforms, to compile a list of potential investments that demonstrate consistent performance despite market volatility.

Is Now the Right Time to Buy? Expert Insights on Valuation Trends

As market conditions fluctuate, many potential buyers are left wondering, Is now the right time to buy? Expert insights suggest that understanding valuation trends can significantly influence this decision. Recently, analysts have noted a steady increase in property values, driven by factors such as low mortgage rates and a competitive housing market. However, it's crucial to assess not only the current prices but also economic indicators like employment rates and inflation, which can provide a clearer picture of future value trends.

In addition to economic factors, local market conditions play a substantial role in determining whether now is the right moment to invest. According to top real estate experts, valuations can vary dramatically from one region to another. For instance, areas experiencing job growth or attractive amenities tend to see higher demand and sustained value increases. Potential buyers should conduct thorough research or consult with real estate professionals to better understand local trends and make informed decisions that align with their financial goals.