Zesty Insights

Dive into the world of news and information with engaging articles.

Why Renters Insurance is the Unsung Hero of Your Lease

Discover why renters insurance is the ultimate safety net for your lease—protect your belongings without breaking the bank!

Top 5 Reasons Renters Insurance is Essential for Every Tenant

Renters insurance is often overlooked, but it plays a crucial role in protecting tenants from unexpected financial burdens. Whether you're renting a small apartment or a larger townhouse, renters insurance provides essential coverage for personal belongings against theft, fire, or other unforeseen disasters. Without this safety net, tenants risk losing thousands of dollars in personal property, leaving them vulnerable and financially strained. Here are the top 5 reasons why every tenant should consider getting renters insurance:

- Protection of Personal Property: Renters insurance covers personal belongings such as furniture, electronics, and clothing from various risks.

- Liability Coverage: If someone is injured in your rented space, renters insurance can help cover legal fees and medical costs.

- Additional Living Expenses: If your rental becomes uninhabitable due to covered events, this insurance helps pay for temporary accommodations.

- Affordable Premiums: Most renters insurance plans are inexpensive, often costing less than a monthly utility bill.

- Peace of Mind: Knowing you have coverage allows tenants to feel secure in their living arrangements, making everyday life less stressful.

What Does Renters Insurance Cover? Unpacking the Benefits

Renters insurance is designed to protect you and your personal belongings in case of unforeseen events, such as theft, fire, or natural disasters. This type of insurance typically covers the personal property of the policyholder, including furniture, electronics, clothing, and even some valuables, depending on the policy. Additionally, renters insurance often includes liability coverage, which can protect you from legal claims arising from injuries or damages that occur within your rented space. This means if a guest gets injured in your home, your policy may cover their medical expenses as well as legal fees if they decide to sue.

Furthermore, many renters insurance policies come with additional living expenses coverage, which assists you in covering costs incurred if you are temporarily displaced from your home due to a covered event. For example, if a fire damages your apartment and you need to stay in a hotel while repairs are made, this coverage can help cover those costs. Understanding these benefits is crucial; it ensures you have the necessary protection to safeguard your belongings and financial future when you choose to rent a home.

Is Renters Insurance Worth It? Debunking Common Myths

Many renters often question, Is renters insurance worth it? This is largely due to the widespread misconceptions surrounding it. A common myth is that renters insurance is too expensive and that landlords provide sufficient coverage. In reality, renters insurance can be quite affordable, costing as little as $10 to $20 a month, depending on various factors like your location and the amount of coverage you select. While landlords carry insurance to protect the building itself, it does not cover your personal belongings in case of theft, fire, or other damages. Therefore, understanding the true cost and benefits is essential for any renter.

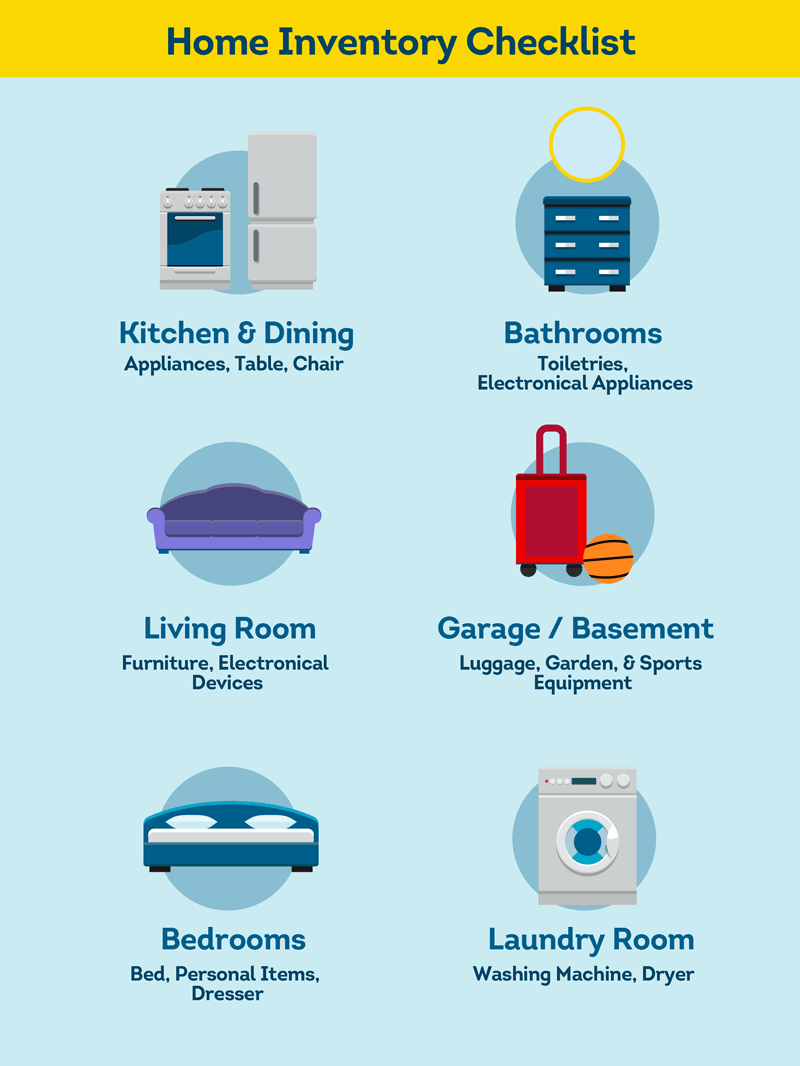

Another myth is that renters insurance is unnecessary for minimal belongings. However, the value of your personal items can quickly accumulate. Take inventory of your possessions, and you may be surprised to find that clothes, electronics, furniture, and personal items can easily total thousands of dollars. Additionally, renters insurance often covers liability for accidents that occur in your rented space, which can be a financial lifesaver. In debunking these myths, it's clear that obtaining renters insurance is not just a safety net; it's a smart financial decision for protecting your assets.