Zesty Insights

Dive into the world of news and information with engaging articles.

Renters Insurance: Your Landlord's Best Friend

Unlock peace of mind! Discover why renters insurance is essential for protecting your belongings and keeping your landlord happy.

What Is Renters Insurance and Why Do You Need It?

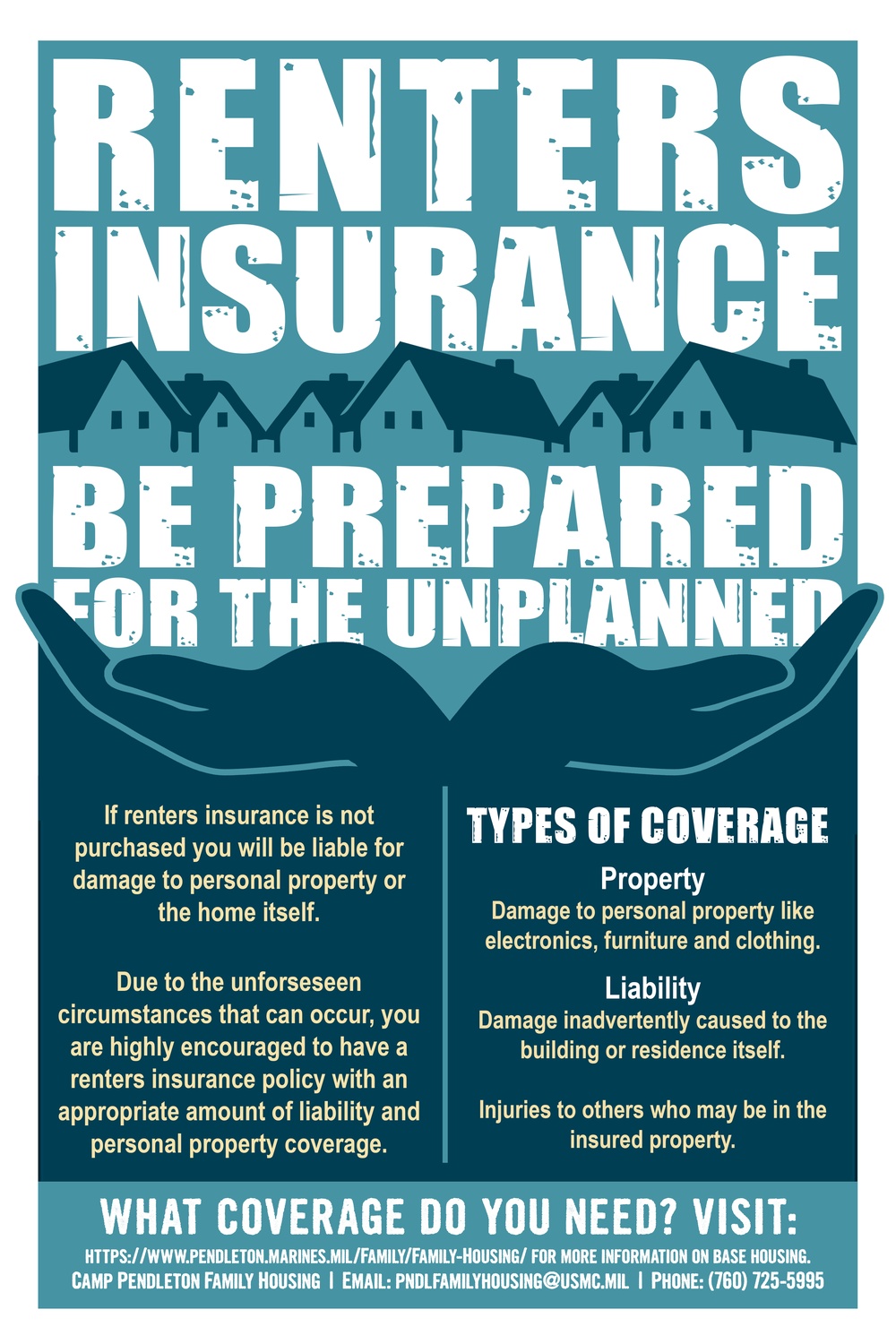

Renters insurance is a type of insurance policy that provides financial protection for individuals who are renting a home or apartment. Unlike homeowners insurance, which covers the dwelling itself, renters insurance protects your personal belongings against risks such as theft, fire, and certain natural disasters. It can also provide liability coverage in case someone is injured while visiting your rented space. This means that if a guest were to trip and fall, renters insurance could help cover medical expenses or legal fees, ensuring that you aren’t left financially vulnerable.

Many tenants may wonder, why do I need renters insurance? The answer lies in the peace of mind it brings. For a relatively low monthly premium, you gain substantial coverage for your possessions, which can include furniture, electronics, and clothing. According to the National Association of Insurance Commissioners, the average renter has around $30,000 worth of personal property. Without insurance, you would have to bear the full cost of replacing these items out of pocket in the event of a disaster. Therefore, investing in renters insurance is not only a smart choice for financial protection but also a responsible step towards safeguarding your belongings.

Top 5 Reasons Renters Insurance Is a Must for Every Tenant

Renters insurance is often overlooked by tenants, but it offers a layer of protection that is vital in today's unpredictable world. Here are the top 5 reasons why renters insurance is a must for every tenant:

- Personal Property Protection: Renters insurance covers your personal belongings, including electronics, furniture, and clothing, from unexpected events like theft, fire, or water damage.

- Liability Coverage: If someone gets injured in your rented space, renters insurance can protect you from hefty legal expenses and medical bills, ensuring you don't face financial ruin.

- Affordable Premiums: The cost of renters insurance is often surprisingly low, especially compared to the peace of mind it provides. Many tenants can find comprehensive coverage for as little as a few dollars a month.

- Additional Living Expenses: If your rental becomes uninhabitable due to a covered peril, renters insurance can cover temporary living expenses, helping you maintain your lifestyle during repairs.

- Required by Landlords: Many landlords require tenants to have renters insurance as part of the lease agreement, making it not just beneficial but often a necessity.

How Renters Insurance Protects You and Your Belongings

Renters insurance provides essential protection for both you and your belongings, ensuring peace of mind while you live in a rented space. This type of insurance typically covers personal property against unforeseen events such as theft, fire, or water damage. For example, if a fire were to break out and damage your furniture and clothing, your renters insurance could help you recover the costs of replacing those lost items. Without this coverage, you would be left to bear the full financial burden, which could be devastating.

In addition to protecting your personal belongings, renters insurance also offers liability coverage. This protection is crucial if someone is injured while visiting your home or if you accidentally cause damage to someone else's property. For instance, if your pet accidentally bites a guest or if a guest trips and falls within your rental unit, your renters insurance could cover medical expenses or related claims. Overall, renters insurance is an affordable way to safeguard your belongings and protect yourself against potential liabilities.