Zesty Insights

Dive into the world of news and information with engaging articles.

Whole Life Insurance: The Policy That Loves You Back

Discover why Whole Life Insurance is the perfect financial partner that grows with you and secures your future!

Understanding Whole Life Insurance: How It Works and Benefits You

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. Unlike term life insurance, which only covers a person for a specified period, whole life insurance guarantees a death benefit to the beneficiary. Additionally, a portion of the premium payments accumulates as cash value, which can be borrowed against or withdrawn in the policyholder's lifetime. This dual benefit makes whole life insurance a compelling choice for those seeking financial security both for their loved ones and themselves.

The benefits of whole life insurance extend beyond just providing a death benefit. Firstly, it simplifies financial planning with its predictable costs and lifelong coverage. Secondly, the cash value component grows at a guaranteed rate, offering a stable foundation for savings. Policyholders can also enjoy tax advantages, as the cash value growth is tax-deferred, and the death benefit is generally not subject to income tax. In essence, understanding whole life insurance can empower you to make informed decisions about your long-term financial strategy.

Is Whole Life Insurance the Right Choice for Your Financial Future?

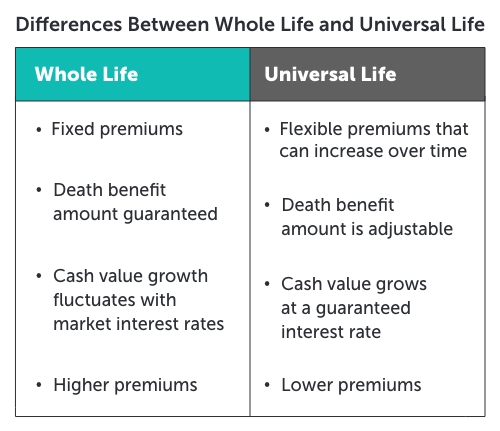

Whole life insurance is often viewed as a stable financial instrument that provides both a death benefit and a cash value component. This type of policy guarantees lifelong coverage, as long as the premiums are paid, which can be appealing for those looking for long-term financial security. Additionally, the cash value accumulates at a guaranteed rate and can be borrowed against or withdrawn, offering policyholders a potential source of liquid funds. However, it is crucial to evaluate whether the higher premiums associated with whole life insurance align with your overall financial goals and budget.

When considering if whole life insurance is the right choice for your financial future, it's essential to assess your unique circumstances. Factors to consider include your age, health, financial responsibilities, and long-term objectives. For individuals who prioritize guaranteed returns and a stable investment, whole life insurance could be an advantageous option. Conversely, if you are comfortable with taking more risks for higher returns, alternative investment vehicles such as term life insurance paired with portfolio investing might better suit your needs. Ultimately, thorough research and consultation with a financial advisor can help clarify if whole life insurance is a fitting addition to your financial strategy.

5 Common Myths About Whole Life Insurance Debunked

Whole life insurance is often shrouded in misconceptions that can deter individuals from seeking the protection and benefits it provides. One common myth is that whole life insurance is only a savings plan. While it does accumulate cash value over time, its primary purpose is to provide lifelong coverage and a death benefit to beneficiaries. This dual functionality can serve as a financial safety net, making it essential for individuals to recognize its comprehensive value rather than dismissing it as merely a savings tool.

Another prevalent misconception is that whole life insurance is too expensive for the average person. In reality, the cost of whole life insurance varies based on factors such as age, health, and the amount of coverage sought. Many policies incorporate flexible payment options to accommodate different budgets, allowing individuals to find a plan that suits their financial situation. By understanding the range of options available, potential buyers can make informed decisions and dispel the myth that whole life insurance is out of reach for most people.