Zesty Insights

Dive into the world of news and information with engaging articles.

Buckle Up for Your Wallet: Savvy Secrets to Car Buying

Unlock savvy secrets to save big on your next car purchase! Buckle up for wallet-friendly tips and tricks that empower your buying journey.

Top 10 Negotiation Tactics for Buying a Car

When it comes to buying a car, employing effective negotiation tactics can make a significant difference in the final price you pay. One of the most essential strategies is to do thorough research beforehand. Understand the market value of the car you're interested in and be familiar with its features and potential alternatives. This knowledge will empower you during discussions with salespeople, enabling you to present compelling arguments for a lower price. Additionally, setting a budget and sticking to it can help you avoid overspending and the common traps of emotional buying.

Another powerful tactic is to be patient and not rush the decision-making process. Salespeople often want to close the deal quickly, so use this to your advantage by taking your time. Be prepared to walk away if you feel pressured or if the terms aren't favorable. This sends a strong message and can sometimes lead to better offers as they may reconsider your proposal. Remember, successful negotiation is about finding a win-win situation, and by maintaining a calm demeanor and clear objectives, you can ensure that you secure the best deal possible on your next car purchase.

How to Avoid Common Car Buying Mistakes

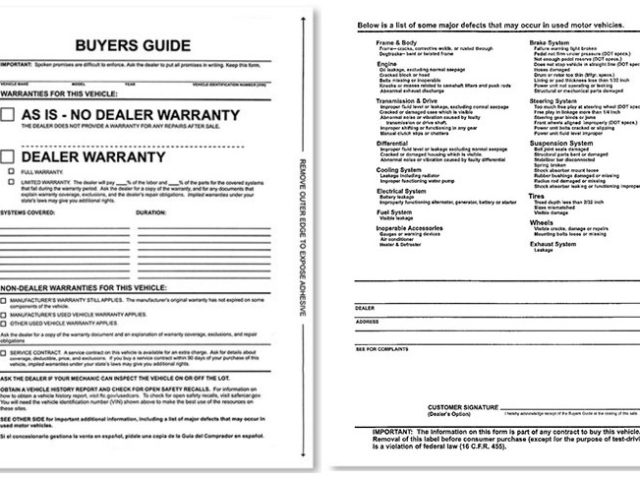

When it comes to purchasing a vehicle, avoiding common car buying mistakes is crucial for ensuring you get the best deal possible. One of the first errors that buyers often make is not conducting enough research. Before you even step into a dealership, take the time to compare prices across various platforms and get a clear understanding of the market value for the make and model you're interested in.

Another prevalent mistake is neglecting to consider the total cost of ownership. Many buyers focus solely on the purchase price and overlook important factors such as insurance rates, fuel economy, and maintenance costs. To avoid this pitfall, create a comprehensive budget that includes these expenses, helping you make an informed decision and ensuring a satisfactory ownership experience.

Is Leasing or Buying a Car Right for You?

When deciding whether leasing or buying a car is right for you, it’s important to consider your lifestyle and financial situation. Leasing typically requires a lower down payment and monthly payments than purchasing a vehicle outright, making it an attractive option for those who prefer to drive newer models without the long-term commitment. However, leasing often comes with mileage limits and potential fees for excessive wear and tear, which can be restrictive for drivers who value flexibility. If you tend to drive long distances or want to customize your vehicle, buying might be the better choice.

Another crucial factor is the long-term costs involved in leasing versus buying. While leasing may seem cheaper in the short term, over time, you could end up paying more if you continually lease new cars every few years. On the other hand, purchasing a vehicle allows you to build equity, and once the loan is paid off, your monthly expenses will significantly decrease. Consider creating a budget to evaluate the overall financial commitment of each option to determine which aligns better with your goals.